CoStar Economy: The struggle to contain inflation continues

CoStar Economy: The struggle to contain inflation continues

The struggle to contain inflation continues

Overall inflation as measured by the consumer price index, or CPI, remains sticky, according to the latest Bureau of Labor Statistics report.

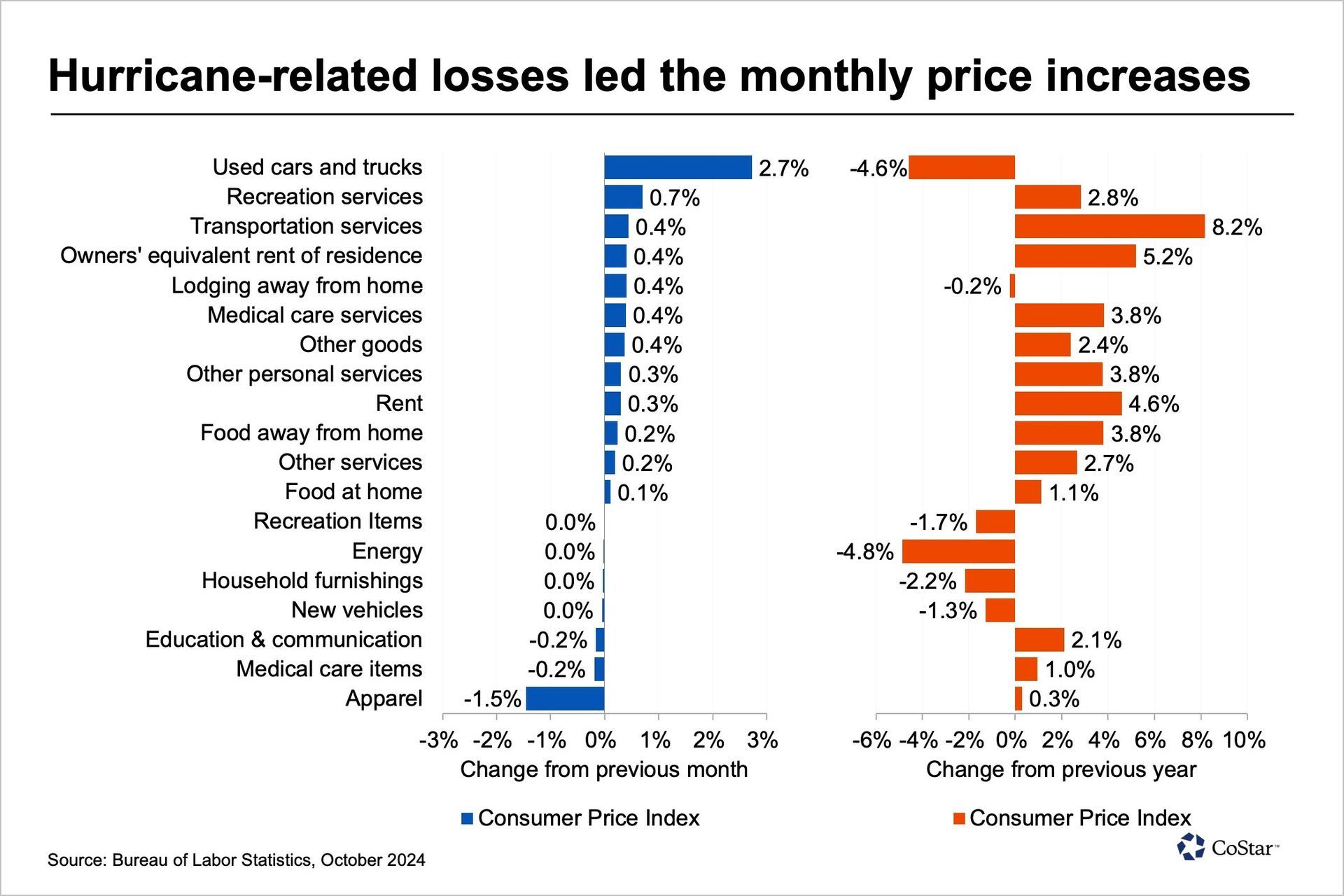

Consumer prices rose by 0.2% in October, generally in line with expectations but pushing year-over-year inflation to 2.6%, up from 2.4% in September. Core CPI, which excludes the volatile categories of food and energy, rose by 3.3% over the year, its third consecutive month of re-acceleration.

While overall prices for physical goods have been flat or falling, the cost of services continued to grow, particularly housing-related costs such as rent and owners' equivalent of rent, which have proven the stickiest price category. At the same time, declining energy costs began to plateau in October after falling 4.8% year over year.

The exception to goods deflation involved used cars and trucks, which saw the largest price increase of any category at 2.7%. Recovery efforts in Southeastern areas after Hurricanes Helene and Milton likely caused the rise as consumers sought to replace flood-damaged vehicles. Automotive data firm Carfax estimates that as many as 138,000 vehicles were water-damaged in Helene.

Shelter price increases were muted. Rents rose 0.3% in October, while owners’ equivalent rents, reflecting the cost of owning a home, were 0.4% higher. These were 4.6% and 5.2% higher than a year ago in October, respectively. They are still higher than pre-pandemic price gains but are both on a steady downward path.

Despite the monthly uptick, inflation has continued to slow in the longer term. The average monthly price increase through the first 10 months of 2024 was 0.22%, down from 0.27% in 2023 and 0.52% at the height of overheating in 2022.

The largest year-over-year price increases were in transportation services, rising by 8.2% despite falling energy prices. However, these can be volatile and will likely be revised lower in November.

Price increases are not stopping shoppers

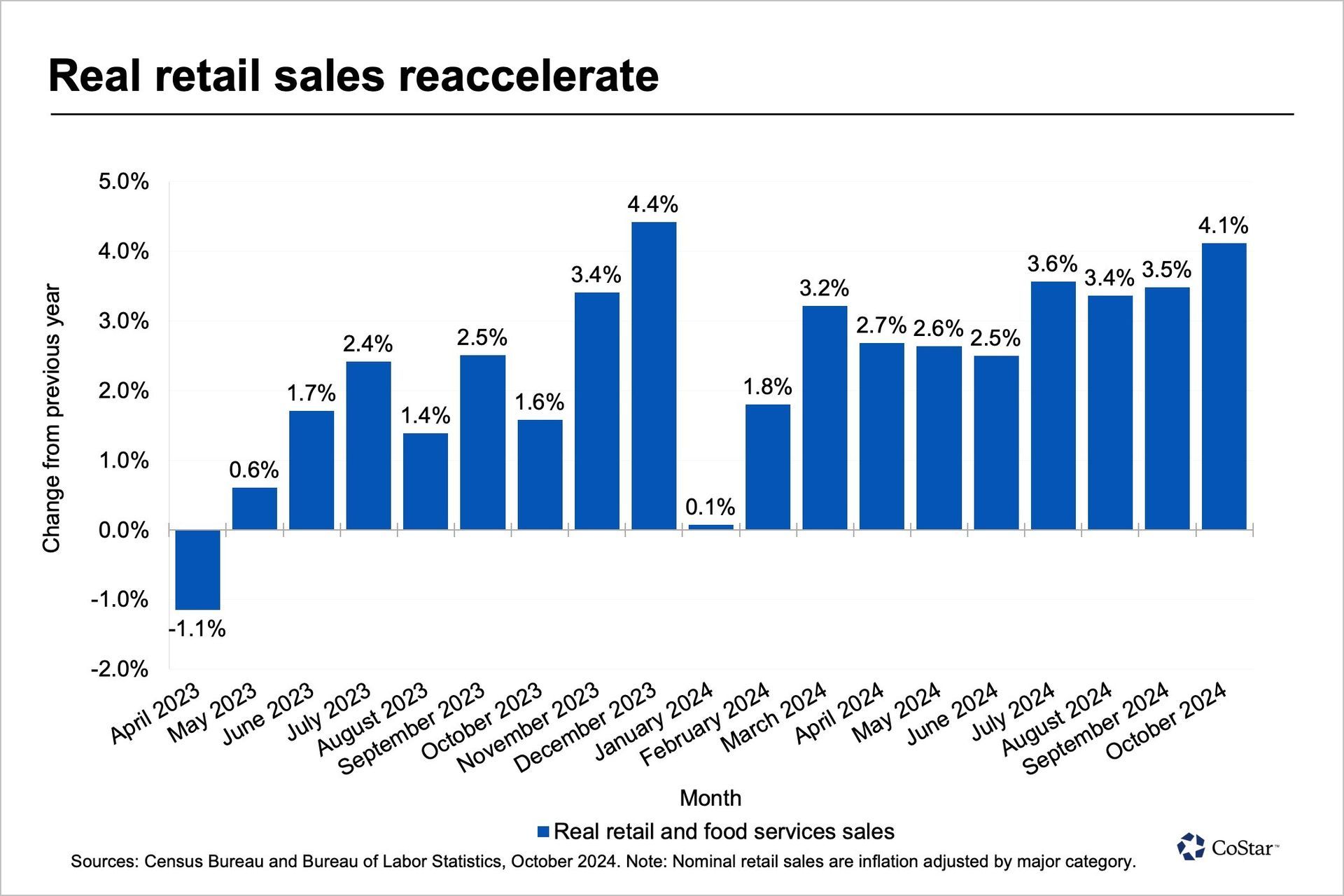

Despite the persistence of inflation, American consumers have shown little signs of slowing heading into the holiday shopping season.

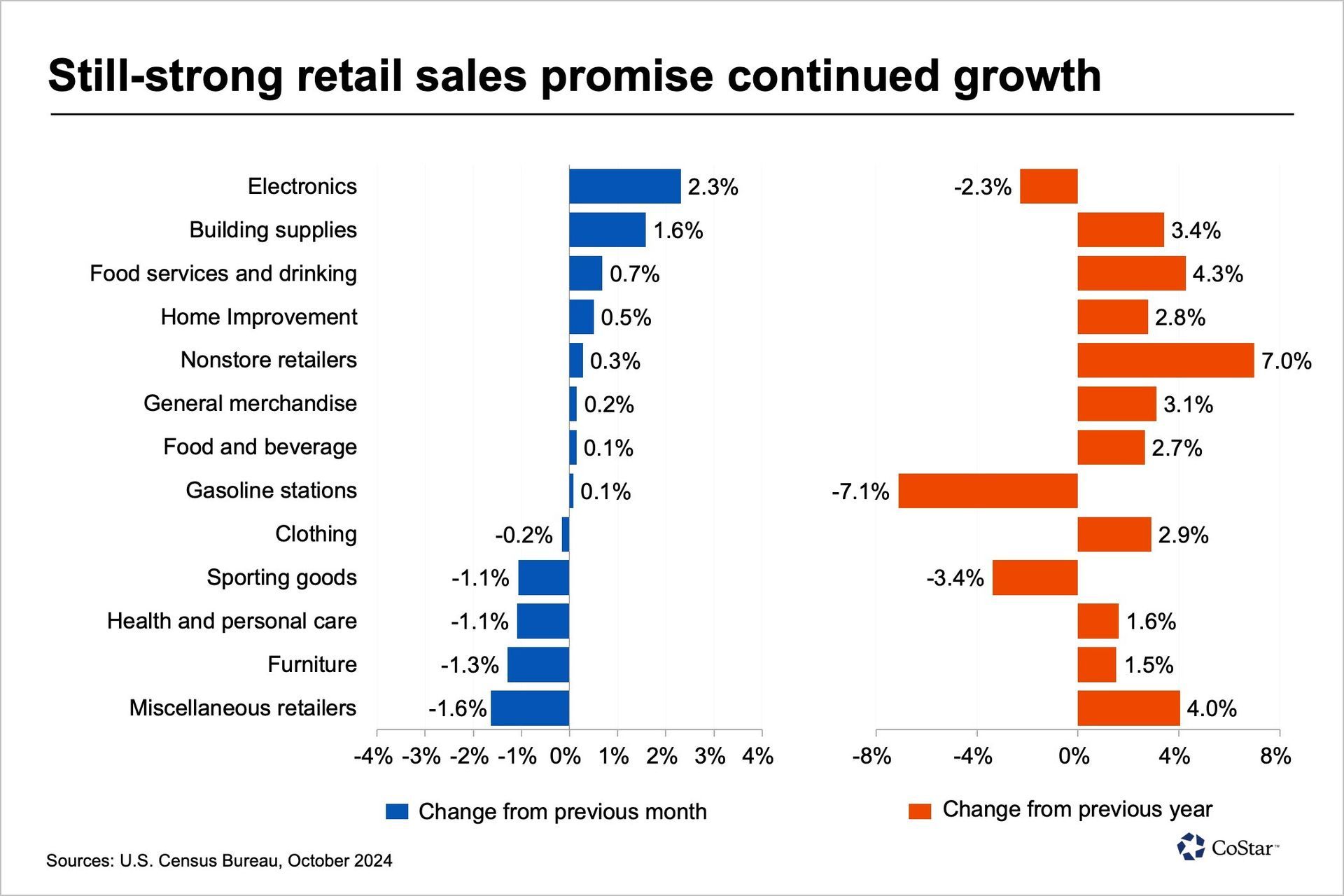

According to U.S. Census Bureau data released last week, retail sales rose 0.4% in October, beating analyst expectations, and September sales were revised higher to 0.8%. That outpaced expectations and brought inflation-adjusted annual retail sales growth to its highest level in nearly one year. Real retail sales were up 4.1% between October 2023 and October 2024, the highest annual real growth rate since December 2023.

The resilience of consumers keeps surprising to the upside. Despite a slowing job market and the burn-off of excess savings from pandemic-era stimulus, continued wage growth, which reached 4% over the past year, has supported steady growth in spending.

Slower long-term inflation, particularly falling gasoline prices earlier in 2024, made some room in Americans’ budgets for more discretionary spending. As gasoline sales fell by more than 7% over the past year, spending at nonstore retailers increased 7%, and spending at bars and restaurants rose 4.3%. Storm recovery may have also driven some retail spending growth as building supplies spending increased 1.6% in October, nearly half its annual growth rate of 3.4%.

What we’re watching …

The continued growth of spending may complicate the Federal Reserve’s plans for lowering interest rates. October data for the Fed’s preferred measure of inflation, the personal consumption expenditures price index, may shed more light on the central bank’s path.

Still, post-election markets predict stronger economic growth via deregulation and fiscal expansion in the coming year, likely to stoke stronger inflationary impulses. Indeed, Fed Chairman Jerome Powell noted in a recent speech that “the economy is not sending any signals that we need to be in a hurry to lower rates.”

Markets are pricing in a 60% probability of a 25-basis-point cut at the Fed’s December meeting, but expectations for multiple rate cuts next year are cooling, disappointing those waiting for rates to return to pre-pandemic levels.

CoStar Economy is produced this week by Christine Cooper, CoStar's managing director and chief U.S. economist, and Chuck McShane, senior director of market analytics.

Keller Williams Realty, Inc. is a real estate franchise company. Each Keller Williams office is independently owned and operated. Keller Williams Realty, Inc. is an Equal Opportunity Employer and supports the Fair Housing Act.

The Summit Group

KW Commercial MN

(A division of Keller Williams Integrity Realty - Saint Paul)

2660 Arthur St,

Roseville, MN 55113

Keller Williams Realty, Inc. is a real estate franchise company. Each Keller Williams office is independently owned and operated. Keller Williams Realty, Inc. is an Equal Opportunity Employer and supports the Fair Housing Act.

The Summit Group

Contact Us | 612.963.5147

KW Commercial MN

(A division of Keller Williams Integrity Realty - Saint Paul)

2660 Arthur St,

Roseville, MN 55113

Keller Williams Realty, Inc. is a real estate franchise company. Each Keller Williams office is independently owned and operated. Keller Williams Realty, Inc. is an Equal Opportunity Employer and supports the Fair Housing Act.

The Summit Group

KW Commercial MN

(A division of Keller Williams Integrity Realty - Saint Paul)

2660 Arthur St,

Roseville, MN 55113